Update: Januari 4th 2021

Since we started our ETF it is a lot easier to track our returns. The updates are more frequent and you can see the progress in realtime. Also when you visit the archive you can see exactly hoe we did it. This year we had a return of 60%. So we have easily beaten the minimum of 40%. With only a limited number of orders and a lot of patience. But we have to be frank. Most all stock preformed really well last year so it was pretty hard not to have a nice return. We hope you have learned a little and if you like what you are reading please support us by buying us a coffee. ![]()

Update: May 6th 2020

Time for an update. I think the Corona crisis might have been the necessary push for the stock markets. Everyrhing was priced way to high and now finally we can buy some stock at normal prices. ETF Trading makes it all worth while. Because there is a lot of volatility in the markets these days and we can profit from that.

Update: April 18th 2020.

It has been a while. So it is time for a new update. So far we had the corona crisis but the rebound from it is quite spectacular.

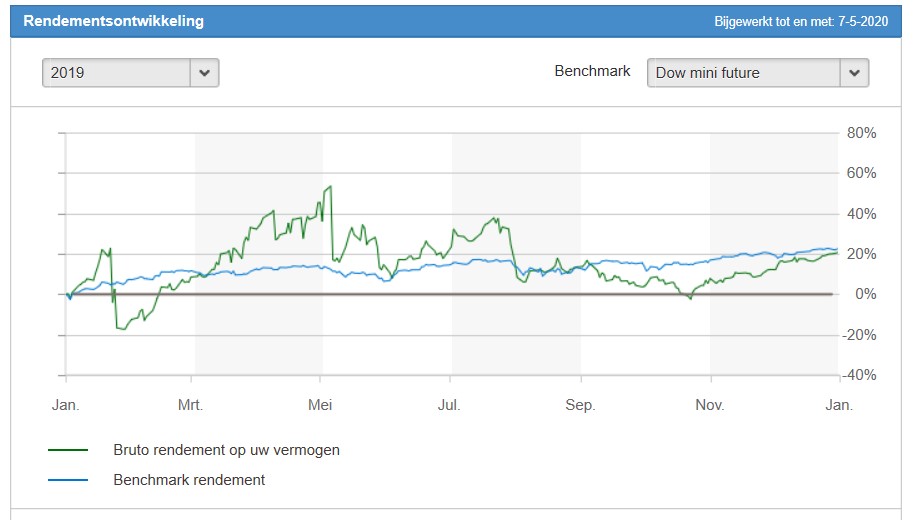

Update: December 2019

It was a very exciting year but in the end we could have just bought an index tracker. That would have saved me a lot of transaction costs. Only my broker got rich in the end of the year.

Update: December 2018

I made a few huge mistakes in the last month of the year. And all my profits vaporized in one month time. We call it learning money. Money you pay to learn from your mistakes.

Update: December 2016

All in all a really nice return in the end. It’s been a rough ride but in the end payed of pretty nice.

Update: November 2016

A trouble some year but we did have a nice return so far. Ithink we beat all the indexes

Update: December 2014

What can I say? What goes up must come down and that’s what happened. My shifting of funds seemed to pay off but I spoke to soon. It’s a little late now to sell in May (Cliché: 762) but it might turn out to be true this year. I have made a terrible mistake with some call options (May14-$260) on Tesla right before the Q1 earnings and lost quite a bit on that one. You can see the drop on may the 8th (on my freaking b-day). It cost me 4% of porto return within 24 hours 🙁 In dutch we call it learning money (leergeld). I have learned an important message and that is to do my own homework and not judge a whole company over 1 persons opinion. I’m getting way to busy with my real work to keep a close eye on everything so I think it is time to decrease some positions. Cash is king atm (Cliché: 429) All in all the last two weeks were shit. Russia still keeps us busy, biotech is still getting hit (except GWP) and we have european elections this year. In the end…Nothing else matters. But we had great fun.

Update: April 27th 2014.

This is a nice one. I’made a slamming 10% this week but that was until mr. Putin came along. My luck is that you will not see that in the graph untill Monday. I usually gain or loose about 2/3 % every week so I thought I would post this update really quick to let you see what a wild run I’m having this month. All my hard work for the past 15 weeks (and years before) gone. Yesterday my profit was exactly 0%. It would have been more profitable to put my money in the bank.

Update: March 30th 2014.

What a two weeks. Nearly all biostocks went down and especially my hemp orientated ones. It was waiting for the bubble to burst and it did.

Update: March 2nd 2014.

It’s a good thing I did not make a chart today. It would have been a dissaster. 😉

Update: December 2013

Stock Trading at my best. A nice start is half the work and I really enjoyed doing it. Getting to now markets and financial instruments.

Update: Januari 2013

This is the start of my investing blog. I’ll try to update it as much as possible but I have to work as well so I do not know if it can be regular.