In short: The Ichimoku Cloud are 5 of indicators that show support and resistance levels, as well as momentum and trend direction. It also uses these figures to produce a “cloud” which attempts to forecast where the price may find support or resistance in the future.

What is the Ichimoku Cloud Indicator?

The Ichimoku Cloud is a collection of technical indicators that show support and resistance levels, as well as momentum and trend direction. It does this by taking multiple averages and plotting them on the chart. It also uses these figures to compute a “cloud” which attempts to forecast where the price may find support or resistance in the future.

The Ichimoku cloud was developed by Goichi Hosoda, a Japanese journalist, and published in the late 1960s. It provides more data points than the standard candlestick chart. The Ichimoku Cloud, also known as Ichimoku Kinko Hyo, is a versatile indicator that defines support and resistance, identifies trend direction, gauges momentum and provides trading signals. Ichimoku Kinko Hyo translates into “one look equilibrium chart”. With one look, chartists can identify the trend and look for potential signals within that trend. The indicator was developed by journalist Goichi Hosoda and published in his 1969 book. Even though the Ichimoku Cloud may seem complicated when viewed on the price chart, it’s actually a rather straightforward indicator; the concepts are easy to understand and the signals are well-defined.

Calculation

Four of the five plots within the Ichimoku Cloud are based on the average of the high and low over a given period of time. For example, the first plot is simply an average of the 9-day high and 9-day low. Before computers were widely available, it would have been easier to calculate this high-low average rather than a 9-day moving average. The Ichimoku Cloud consists of five plots:

Tenkan-sen (Conversion Line): (9-period high + 9-period low)/2)) The default setting is 9 periods and can be adjusted. On a daily chart, this line is the midpoint of the 9-day high-low range, which is almost two weeks.

Kijun-sen (Base Line): (26-period high + 26-period low)/2)) The default setting is 26 periods and can be adjusted. On a daily chart, this line is the midpoint of the 26-day high-low range, which is almost one month).

Senkou Span A (Leading Span A): (Conversion Line + Base Line)/2)) This is the midpoint between the Conversion Line and the Base Line. The Leading Span A forms one of the two cloud boundaries. It is referred to as "Leading" because it is plotted 26 periods in the future and forms the faster cloud boundary.

Senkou Span B (Leading Span B): (52-period high + 52-period low)/2)) On the daily chart, this line is the midpoint of the 52-day high-low range, which is a little less than 3 months. The default calculation setting is 52 periods, but can be adjusted. This value is plotted 26 periods in the future and forms the slower cloud boundary.

Chikou Span (Lagging Span): Close plotted 26 days in the past The default setting is 26 periods, but can be adjusted.

What Does the Ichimoku Cloud Tell You?

The technical indicator shows relevant information at a glance using averages.

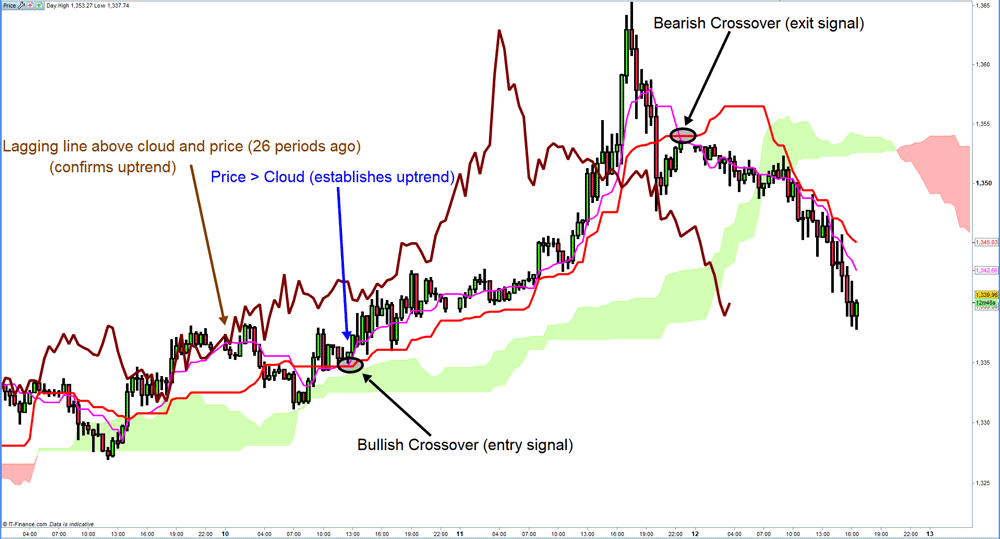

The overall trend is up when price is above the cloud, down when price is below the cloud, and trendless or transitioning when price is in the cloud.

When Leading Span A is rising and above Leading Span B, this helps confirm the uptrend and space between the lines is typically colored green. When Leading Span A is falling and below Leading Span B, this helps confirm the downtrend. The space between the lines is typically colored red, in this case.

Traders will often use the Cloud as an area of support and resistance depending on the relative location of the price. The Cloud provides support/resistance levels that can be projected into the future. This sets the Ichimoku Cloud apart from many other technical indicators that only provide support and resistance levels for the current date and time.

Traders should use the Ichimoku Cloud in conjunction with other technical indicators to maximize their risk-adjusted returns. For example, the indicator is often paired with the Relative Strength Index (RSI), which can be used to confirm momentum in a certain direction. It’s also important to look at the bigger trends to see how the smaller trends fit within them. For example, during a very strong downtrend, the price may push into the cloud or slightly above it, temporarily, before falling again. Only focusing on the indicator would mean missing the bigger picture that the price was under strong longer-term selling pressure.

Crossovers are another way the indicator can be used. Watch for the conversion line to move above the base line, especially when price is above the cloud. This can be a powerful buy signal. One option is to hold the trade until the conversion line drops back below the base line. Any of the other lines could be used as exit points as well.