It is generally assumed that the average yearly return on stock is about 8%. Some say more like 10% some say less like 7%. But let’s assume it is about 8%. Now let’s look at the value of the dollar towards the euro for the past few years. It is a decrease of about 8%. So for an european investor to invest in regular american stock returning about 8%. A decrease in exchange rate brings you exactly nothing, zero, 0, nada, noppes, zilch.

What is the average yearly return?

The average stock market return is about 10% per year for nearly the last century. The S&P 500 is often considered the benchmark measure for annual stock market returns. Though 10% is the average stock market return, returns in any year are far from average. Here’s what new investors starting today should know about stock market returns

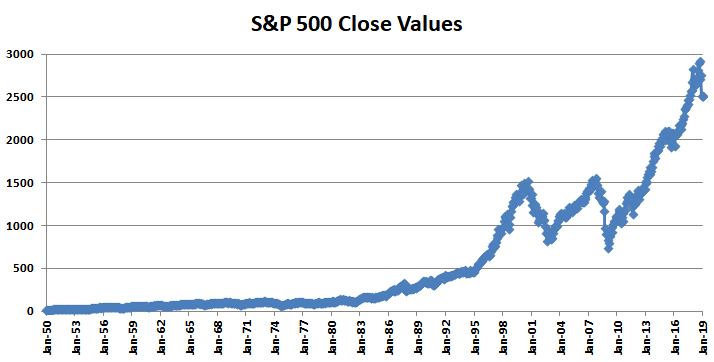

The S&P 500 index comprises about 500 of America’s largest publicly traded companies and is considered the benchmark measure for annual returns. When investors say “the market,” they mean the S&P 500. Keep in mind: The market’s long-term average of 10% is only the “headline” rate: That rate is reduced by inflation. Currently, investors can expect to lose purchasing power of 2% to 3% every year due to inflation. The stock market is geared toward long-term investments — money you don’t need for at least five years. For shorter time frames, you’ll want to stick to lower-risk options — like an online savings account — and you’d expect to earn a lower return in exchange for that safety. Here’s our list of the best high-yield online savings accounts. The graph below shows the current value of the S&P 500, as well as its year-to-date, 5-year and 10-year returns. Between 1990 and today, you can see there have been up years and down years, but over this 30-year period, those fluctuations have averaged out as a positive return.

While 10% might be the average, the returns in any given year are far from average. In fact, between 1926 and 2014, returns were in that “average” band of 8% to 12% only six times. The rest of the time they were much lower or, usually, much higher. Volatility is the state of play in the stock market. But even when the market is volatile, returns tend to be positive in a given year. Of course, it doesn’t rise every year, but over time the market has gone up in about 70% of years.

There are no guarantees in the market, but this 10% average has held remarkably steady for a long time.

So what kind of return can investors reasonably expect today from the stock market?

The answer to that depends a lot on what’s happened in the recent past. But here’s a simple rule of thumb: The higher the recent returns, the lower the future returns, and vice versa. Generally speaking, if you’re estimating how much your stock-market investment will return over time, we suggest using an average annual return of 6% and understanding that you’ll experience down years as well as up years. You can use any investment calculator to see what 6% growth looks like based on how much you’re planning to invest.

So remember:

Temper your enthusiasm during good times. Congratulations, you’re making money. However, when stocks are running high, remember that the future is likely to be less good than the past. It seems investors have to relearn this lesson during every bull market cycle.