Categorie: Valuation

Quarterly Earnings

In short: Quarterly Earnings is an obligated financial report that covers three months of the year, A quarterly earnings report is a quarterly filing made by public companies to report their performance. Earnings reports include items such as net income, earnings per share, earnings from continuing operations, and net sales. By analyzing quarterly earnings…

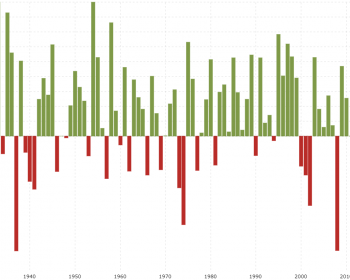

Average Yearly Return

the Relative Strenght Index (RSI)

In short: The relative strength index tells you when a stock is overbought or oversold. The relative strength index (RSI) is a technical indicator used in the analysis of financial markets. It is intended to chart the current and historical strength or weakness of a stock or market based on the closing prices of a recent trading…

Return On Investment

In short: The Rate Of Return or Return On Investment (R.O.I.) is a percentage of the total end value measured against the initial amount of the investment. Official definition: “A profitability measure that evaluates the performance of a business by dividing net profit by net worth“. Return on investment, or ROI,…

Oversold

In short: Oversold is when there are much more sell orders than buy orders. What is an oversold condition? To understand the term oversold you should really first know what the RSI (relative strenght index) is. The term oversold refers to a condition where a stock has traded lower in…

Overbought

In short: Overbought is when there are much more buy orders than sell orders. What is an overbought condition? To understand the term overbought you should really first know what the RSI (relative strenght index) is. The term overbought refers to a condition currently above its intrinsic or fair value….

Fair Value

Quarterly Earnings

In short: Quarterly Earnings is an obligated financial report that covers three months of the year, A quarterly earnings report is a quarterly filing made by public companies to report their performance. Earnings reports include items such as net income, earnings per share, earnings from continuing operations, and net sales. By analyzing quarterly earnings…

Average Yearly Return

the Relative Strenght Index (RSI)

In short: The relative strength index tells you when a stock is overbought or oversold. The relative strength index (RSI) is a technical indicator used in the analysis of financial markets. It is intended to chart the current and historical strength or weakness of a stock or market based on the closing prices of a recent trading…

Return On Investment

In short: The Rate Of Return or Return On Investment (R.O.I.) is a percentage of the total end value measured against the initial amount of the investment. Official definition: “A profitability measure that evaluates the performance of a business by dividing net profit by net worth“. Return on investment, or ROI,…

Oversold

In short: Oversold is when there are much more sell orders than buy orders. What is an oversold condition? To understand the term oversold you should really first know what the RSI (relative strenght index) is. The term oversold refers to a condition where a stock has traded lower in…

Overbought

In short: Overbought is when there are much more buy orders than sell orders. What is an overbought condition? To understand the term overbought you should really first know what the RSI (relative strenght index) is. The term overbought refers to a condition currently above its intrinsic or fair value….