In short: Oversold is when there are much more sell orders than buy orders.

What is an oversold condition?

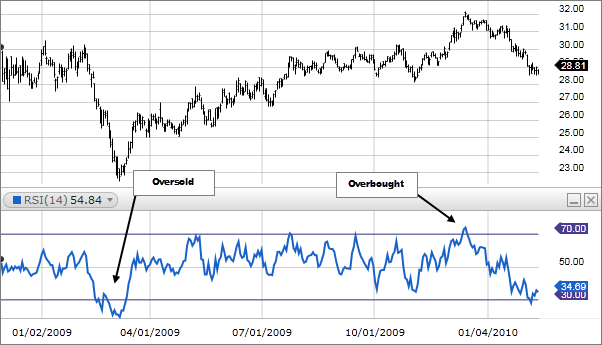

To understand the term oversold you should really first know what the RSI (relative strenght index) is. The term oversold refers to a condition where a stock has traded lower in price and has the potential for a price bounce. An oversold condition can last for a long time, and therefore being oversold doesn’t mean a price rally will come soon, or at all. Many technical indicators identify oversold and overbought levels. These indicators base their assessment on where the price is currently trading relative to prior prices. Fundamentals can also be used to assess whether an asset is potentially oversold and has deviated from its typical value metrics. When there are more sell orders than buy orders we speak of an oversold situation.

Like in below chart in March 2009: