In short: The ROC Indicator is a momentum indicator. It measures the percentage of change compared to a previous period(s). With this you can see ahead of time if a stock is overbought or oversold or when the momentum changes.

What is the rate of change Indicator (ROC) ?

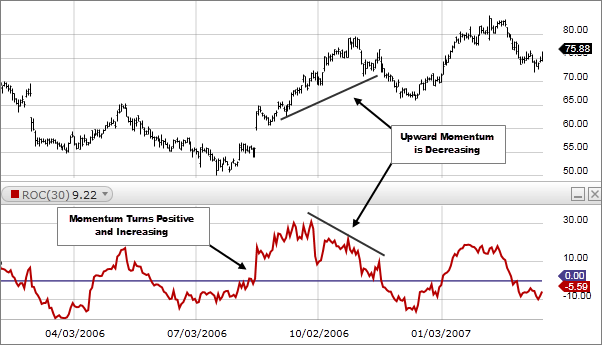

Rate of Change (ROC) is obviously closely tied to price. When prices are rising or advancing, ROC values remain above the Zero Line (positive) and when they are falling or declining, they remain below the Zero Line (negative).

Also, keep in mind that even though ROC is an oscillator, it is not bounded to a set range. The reason for this is that there is no limit to how far a security can advance in price but of course there is a limit to for far it can decline. If price goes to $0, then it obviously will not decline any further. Because of this, ROC can sometimes appear to be unbalanced.

What to look for

Trend Identification

The Rate of Change (ROC) indicator is can be a good tool for identifying the overall long term trend of a financial instrument. This may not lead to a signal independently, however it can help confirm other, signal-generating conditions.

Overbought and Oversold

As previously mentioned, ROC is not range bound like many other oscillators. Because of this, identifying overbought and oversold conditions can be a little less straightforward. Knowing where to place the overbought and oversold thresholds can be difficult. The best way to accomplish this, is by using research and historical analysis. A technical analyst can look at past price movements compared to the ROC to get a better sense of when an instrument is truly overbought or oversold.

With the Rate of Change indicator (ROC) it is important to remember that it is best to view it as just one piece of the puzzle. ROC can generate some signals (as seen with overbought and oversold conditions). However, it really becomes most effective when confirming signals or conditions identified by additional technical analysis. Momentum is an extremely important factor when analyzing price movements, and the ROC analyzes momentum quite well. Because of this, it is a valuable technical analysis tool.