In short: Overbought is when there are much more buy orders than sell orders.

What is an overbought condition?

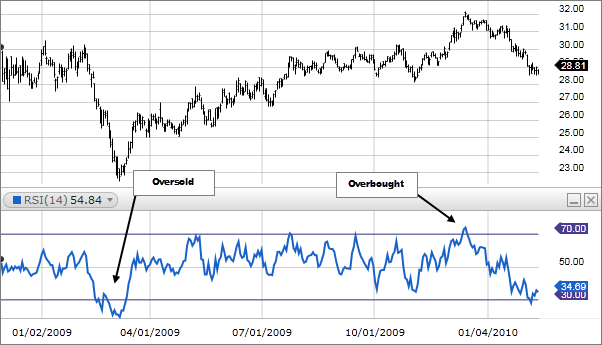

To understand the term overbought you should really first know what the RSI (relative strenght index) is. The term overbought refers to a condition currently above its intrinsic or fair value. Overbought generally describes recent or short-term movement in the price of the stock, and reflects an expectation that the market will correct the price in the near future. This belief is often the result of technical analysis of the security’s price history, but fundamentals may also be employed. A stock that is overbought may be a good candidate for sale. The opposite of overbought is oversold, where a security is thought to be trading below its intrinsic value.

Like in the below chart in March 2010: