In short: The ATR indicator takes the current period high/low range compared to the previous high/low range. It is most usefull in measuring the strength of a move. if a stock makes a move there will be an increase in volatility. In that case the ATR will be on the rise.

What is the True Range Indicator?

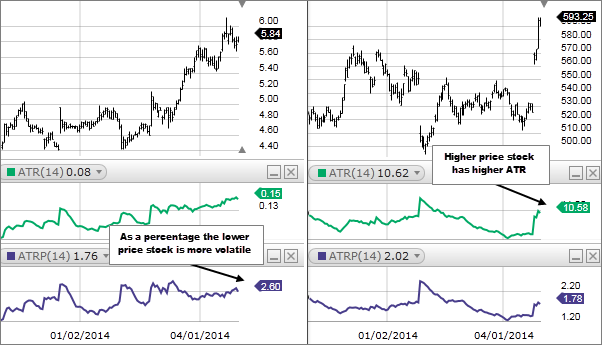

Average True Range Indicator (ATR) or Average True Range Percent (ATRP) s a tool used in technical analysis to measure volatility. Unlike many of today’s popular indicators, the ATR is not used to indicate the direction of price. Rather, it is a metric used solely to measure volatility, especially volatility caused by price gaps or limit moves.

J. Welles Wilder created the ATR and featured it in his book New Concepts in Technical Trading Systems. The book was published in 1978 and also featured several of his now classic indicators such as; The Relative Strength Index, Average Directional Index and the Parabolic SAR. Much like the indicators mentioned, the ATR is still widely used and has great importance in the world of technical analysis.

Calculation

To calculate the ATR, the True Range first needs to be discovered. True Range takes into account the most current period high/low range as well as the previous period close if necessary. There are three calculation which need to be completed and then compared against each other. The True Range is the largest of the following:

The Current Period High minus (-) Current Period Low The Absolute Value (abs) of the Current Period High minus (-) The Previous Period Close The Absolute Value (abs) of the Current Period Low minus (-) The Previous Period Close

true range = max[(high - low), abs(high - previous close), abs (low - previous close)]

*Absolute Value is used because the ATR does not measure price direction, only volatility. Therefore there should be no negative numbers. *Once you have the True Range, the Average True Range can be plotted. The ATR is an Exponential Moving Average of the True Range.

The basics

Average True Range is a continuously plotted line usually kept below the main price chart window. The way to interpret the Average True Range is that the higher the ATR value, then the higher the level of volatility.

- The look back period to use for the ATR is at the trader’s discretion however 14 days is the most common.

- ATR can be used with varying periods (daily, weekly, intraday etc.) however daily is typically the period used.