Auteur: the Wiseguy

Trendlines

In short: Trendlines are used in TA to quickly point out the general direction of a stockprice by connecting the highs and the lows. Unlike horizontal support and resistance, trendlines are diagonal or slanted areas of value. Trendlines do behave like support and resistance in that price action can be confined…

A Bear Market

In short: A Bear Market when stocks in general go down more than 20% we call it a bear market. A bear market occurs when the price of an investment falls at least 20% from its high. For example, when the Dow Jones Industrial Average continued a decline on March 11 from its…

the Nasdaq Index

In short: The Nasdaq is a Tech index of 100 largest Tech companies. The NASDAQ Composite (ticker symbol ^IXIC) is a stock market index of the common stocks and similar securities (e.g. ADRs, tracking stocks, limited partnership interests) listed on the Nasdaq stock market. Along with the Dow Jones Industrial Average and S&P 500 it is one of the three most-followed indices in US stock markets. The…

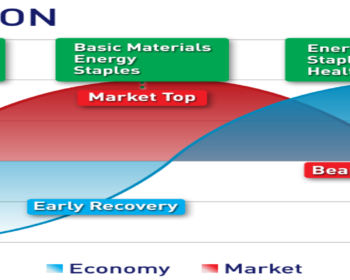

Sector Rotation

Fair Value

Leading and lagging indicators

In short: Technical traders use indicators to identify market patterns and trends. Most of these indicators fall into two categories: leading and lagging. Leading tries to predict the future, Lagging shows exactly what has been. What is a leading technical indicator? A leading indicator is a tool designed to anticipate…

Why do we focus on TA

Best Brokers (online)

In short: Online Brokers come in 2 types, full-service and self-service. Depending on what kind of service you expect there is a fee that you (eventually) pay. There are many online brokers, Some are expensive, some are plain cheap. Some are simple (but lack features), some are very advanced (but…