Categorie: WIKIPEDIA

Moving Average (MA)

Average True Range (ATR) indicator

In short: The ATR indicator takes the current period high/low range compared to the previous high/low range. It is most usefull in measuring the strength of a move. if a stock makes a move there will be an increase in volatility. In that case the ATR will be on the rise….

Line Chart

In short: A line chart connects data points using a line, usually from the closing price of each time period. The line chart is the most basic chart type and it uses only one data point to form the chart. When it comes to technical analysis, a line chart is…

the Baltic Dry Index (transportation index)

In short: The Baltic Dry gives an overview of the average cost of transporting raw materials around the world. The Baltic Dry Index (BDI) is a measure of what it costs to ship raw materials—like iron ore, steel, cement, coal and so on—around the world. The Baltic Dry Index is…

the Vix Index

In short: The Volatility or Fear index measures the price swing in the markets for the next 30 days by looking at the price of options. What Is the CBOE Volatility Index (VIX)? Created by the Chicago Board Options Exchange (CBOE), the Volatility Index, or VIX, is a real-time market index that represents the…

the Relative Strenght Index (RSI)

In short: The relative strength index tells you when a stock is overbought or oversold. The relative strength index (RSI) is a technical indicator used in the analysis of financial markets. It is intended to chart the current and historical strength or weakness of a stock or market based on the closing prices of a recent trading…

Return On Investment

In short: The Rate Of Return or Return On Investment (R.O.I.) is a percentage of the total end value measured against the initial amount of the investment. Official definition: “A profitability measure that evaluates the performance of a business by dividing net profit by net worth“. Return on investment, or ROI,…

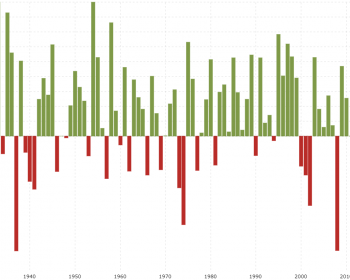

Rate Of Change (ROC) indicator

In short: The ROC Indicator is a momentum indicator. It measures the percentage of change compared to a previous period(s). With this you can see ahead of time if a stock is overbought or oversold or when the momentum changes. What is the rate of change Indicator (ROC) ? Rate…

Pivot Point Indicator

In short: a Pivot Point is a trend analyser by looking at the high, low and closing price from the previous trading session. A Pivot Point is a popular indicator commonly used by technical traders to determine the overall market trends, as well as potential support/resistance levels over different time frames. Floor…

Moving Average (MA)

Average True Range (ATR) indicator

In short: The ATR indicator takes the current period high/low range compared to the previous high/low range. It is most usefull in measuring the strength of a move. if a stock makes a move there will be an increase in volatility. In that case the ATR will be on the rise….

Line Chart

In short: A line chart connects data points using a line, usually from the closing price of each time period. The line chart is the most basic chart type and it uses only one data point to form the chart. When it comes to technical analysis, a line chart is…

the Baltic Dry Index (transportation index)

In short: The Baltic Dry gives an overview of the average cost of transporting raw materials around the world. The Baltic Dry Index (BDI) is a measure of what it costs to ship raw materials—like iron ore, steel, cement, coal and so on—around the world. The Baltic Dry Index is…

the Vix Index

In short: The Volatility or Fear index measures the price swing in the markets for the next 30 days by looking at the price of options. What Is the CBOE Volatility Index (VIX)? Created by the Chicago Board Options Exchange (CBOE), the Volatility Index, or VIX, is a real-time market index that represents the…

the Relative Strenght Index (RSI)

In short: The relative strength index tells you when a stock is overbought or oversold. The relative strength index (RSI) is a technical indicator used in the analysis of financial markets. It is intended to chart the current and historical strength or weakness of a stock or market based on the closing prices of a recent trading…

Return On Investment

In short: The Rate Of Return or Return On Investment (R.O.I.) is a percentage of the total end value measured against the initial amount of the investment. Official definition: “A profitability measure that evaluates the performance of a business by dividing net profit by net worth“. Return on investment, or ROI,…

Rate Of Change (ROC) indicator

In short: The ROC Indicator is a momentum indicator. It measures the percentage of change compared to a previous period(s). With this you can see ahead of time if a stock is overbought or oversold or when the momentum changes. What is the rate of change Indicator (ROC) ? Rate…

Pivot Point Indicator

In short: a Pivot Point is a trend analyser by looking at the high, low and closing price from the previous trading session. A Pivot Point is a popular indicator commonly used by technical traders to determine the overall market trends, as well as potential support/resistance levels over different time frames. Floor…