Categorie: Definitions

What does GAS (and gwei) mean in crypto terms?

In short: “A blockchain network needs some form of energy to keep going, and this energy is usually the computational power that will help users complete orders. That energy is called gas or gas=fee. For the Etherium network the gasfee is measured in GWEI” Bitcoin and other first-generation cryptocurrencies allow…

What is payment for order flow?

HFT – High Frequency Trading (is helping)

Gone are the dealers on NASDAQ and the specialists at the NYSE. Instead, a company’s stock can now be traded on up to sixty competing venues where a computer matches incoming orders. A majority of quotes are now posted by high-frequency traders (HFTs), making them the dominant source of liquidity in the market.

Fibonacci

In short: Fibonacci retracements are based on the key numbers identified by mathematician Leonardo Fibonacci in the 13th century. Fibonacci’s sequence is expressed as ratios, between the numbers in the series. Fibonacci Retracements are ratios used to identify potential reversal levels. These ratios are found in the Fibonacci sequence. The most popular Fibonacci…

A Bull Market

In short: A Bull Market when stocks in general go up about 20% we call it a bull market. A bull market is the market condition when prices continue to rise. Markets follow two general trends over time. Either prices are in an upswing (increase) or they are in a…

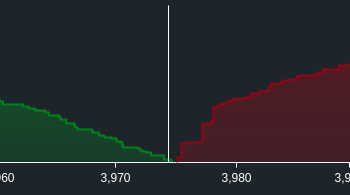

A Bear Market

In short: A Bear Market when stocks in general go down more than 20% we call it a bear market. A bear market occurs when the price of an investment falls at least 20% from its high. For example, when the Dow Jones Industrial Average continued a decline on March 11 from its…

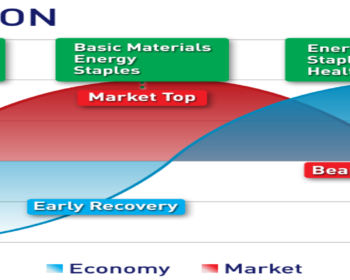

Sector Rotation

What does GAS (and gwei) mean in crypto terms?

In short: “A blockchain network needs some form of energy to keep going, and this energy is usually the computational power that will help users complete orders. That energy is called gas or gas=fee. For the Etherium network the gasfee is measured in GWEI” Bitcoin and other first-generation cryptocurrencies allow…

What is payment for order flow?

HFT – High Frequency Trading (is helping)

Gone are the dealers on NASDAQ and the specialists at the NYSE. Instead, a company’s stock can now be traded on up to sixty competing venues where a computer matches incoming orders. A majority of quotes are now posted by high-frequency traders (HFTs), making them the dominant source of liquidity in the market.

Fibonacci

In short: Fibonacci retracements are based on the key numbers identified by mathematician Leonardo Fibonacci in the 13th century. Fibonacci’s sequence is expressed as ratios, between the numbers in the series. Fibonacci Retracements are ratios used to identify potential reversal levels. These ratios are found in the Fibonacci sequence. The most popular Fibonacci…

A Bull Market

In short: A Bull Market when stocks in general go up about 20% we call it a bull market. A bull market is the market condition when prices continue to rise. Markets follow two general trends over time. Either prices are in an upswing (increase) or they are in a…

A Bear Market

In short: A Bear Market when stocks in general go down more than 20% we call it a bear market. A bear market occurs when the price of an investment falls at least 20% from its high. For example, when the Dow Jones Industrial Average continued a decline on March 11 from its…