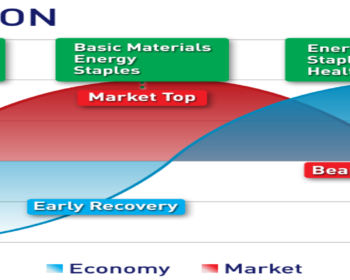

A Bull Market

In short: A Bull Market when stocks in general go up about 20% we call it a bull market. A bull market is the market condition when prices continue to rise. Markets follow two general trends over time. Either prices are in an upswing (increase) or they are in a…