Categorie: Technical Analysis

Support And Resistance Lines

In short: Support and resistance trendlines are horizontally drawn lines to indicate where the price might end or gain strength. In stock market technical analysis, support and resistance are certain predetermined levels of the price of a security at which it is thought that the price will tend to stop and reverse. These levels are denoted by…

Candlesticks

Bar Charts

TA (Technical Analysis)

In short: Technical Analysis is trying to predict the direction of prices through the study of market data via graphics. Primarly price and volume. Behavioral economics and quantitative analysis use many of the same tools of technical analysis, which, being an aspect of active management, stands in contradiction to much of modern portfolio theory. The efficacy…

Line Chart

In short: A line chart connects data points using a line, usually from the closing price of each time period. The line chart is the most basic chart type and it uses only one data point to form the chart. When it comes to technical analysis, a line chart is…

Parabolic Stop and Reverse (SAR)

What is Parabolic SAR? In short: The SAR or stop-reverse-system determines the direction of the stockprice ahead of time. The Parabolic SAR is a technical indicator developed by J. Welles Wilder to determine the direction that an asset is moving. The indicator is also referred to as a stop and…

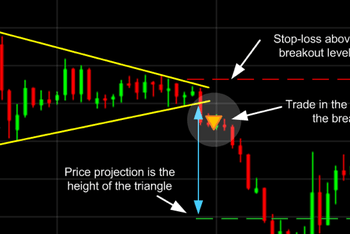

Trendlines

In short: Trendlines are used in TA to quickly point out the general direction of a stockprice by connecting the highs and the lows. Unlike horizontal support and resistance, trendlines are diagonal or slanted areas of value. Trendlines do behave like support and resistance in that price action can be confined…

Why do we focus on TA

Support And Resistance Lines

In short: Support and resistance trendlines are horizontally drawn lines to indicate where the price might end or gain strength. In stock market technical analysis, support and resistance are certain predetermined levels of the price of a security at which it is thought that the price will tend to stop and reverse. These levels are denoted by…

Candlesticks

Bar Charts

TA (Technical Analysis)

In short: Technical Analysis is trying to predict the direction of prices through the study of market data via graphics. Primarly price and volume. Behavioral economics and quantitative analysis use many of the same tools of technical analysis, which, being an aspect of active management, stands in contradiction to much of modern portfolio theory. The efficacy…

Line Chart

In short: A line chart connects data points using a line, usually from the closing price of each time period. The line chart is the most basic chart type and it uses only one data point to form the chart. When it comes to technical analysis, a line chart is…

Parabolic Stop and Reverse (SAR)

What is Parabolic SAR? In short: The SAR or stop-reverse-system determines the direction of the stockprice ahead of time. The Parabolic SAR is a technical indicator developed by J. Welles Wilder to determine the direction that an asset is moving. The indicator is also referred to as a stop and…

Trendlines

In short: Trendlines are used in TA to quickly point out the general direction of a stockprice by connecting the highs and the lows. Unlike horizontal support and resistance, trendlines are diagonal or slanted areas of value. Trendlines do behave like support and resistance in that price action can be confined…